Owensboro Net Profit License Fee Return

Are you considering applying for a business license in Owensboro?

(Minimum Annual License Fee) Every business or individual subject to the City of Owensboro/Daviess County, KY Occupational License Ordinance is required to complete this application and return it to the City of Owensboro. Annual Occupational License Tax Return. Annually, each business must file an Occupational License Tax Return based on work performed during the preceding year. The license fee is equal to 0.125% (.00125) of gross receipts from sales, services rendered or work done in the city.

It is critical to understand that the business license in Owensboro, Kentucky is called the Occupational License Fee. This fee allows you to have the privilege to conduct business in the City of Owensboro. Unlike other cities in Kentucky, this fee is imposed to both residents and non-residents alike who wish to pursue business activities in City’s corporate limits. You can download the Occupational License Application directly from the City of Owensboro’s website: https://www.owensboro.org/page/doing-business-in-owensboro. You can also obtain the application from another section of their website: http://www.owensboro.org/finance. The form is entitled, “Business License Application.”

You can mail the completed application to P.O. Box 10008, Owensboro, KY 42303 with a copy of a valid photo identification and fee or you can submit it in person at City of Owensboro at 101 East 4th Street, Owensboro, KY 42303.

Who is required to have a business license or Occupational License in Owensboro, Kentucky?

Anyone who plans to engage in entrepreneurial activity with anyone in the City’s corporate limits is required to have a license. Any person or individual, partnership, corporation, or legal entity is required to register with the Occupational License Division, even non-profit organizations. The application or registration form is mandated by the City to be signed and approved by the Planning and Zoning Department.

Are there fees and costs associated with getting an Owensboro business license?

Yes. The fee is known to the City of Owensboro as the Occupational License Fee and is a certain cost or a 1.33% privilege license fee based on the gross receipts or sales, whichever is greater. For first time business owners, the fee is due at the time of registering your business with the Occupational License Division. The annual net receipts are all of the earnings received by any person, corporation, fiduciary, enterprise, association, or any entity involved with any trade, profession, job, occupation, or any other entrepreneurial activity for the duration of each year. If the receipts or sales are less than $3,500, then the City of Owensboro levies the occupational license tax based upon the gross receipts at 1.33%. Infrequently, the license fee can vary for special classification fee types. For information on whether or not your business venture will fall into such a category please call the City of Owensboro at (270) 687-4444.

What basic information will be needed for an Owensboro business license?

You will need to provide the name of the business, the applicant’s name and telephone number, the applicant’s residential address, the applicant’s date of birth and social security number, the business location, the type of ownership, a Federal Identification Number, the type of business activity and a signature.

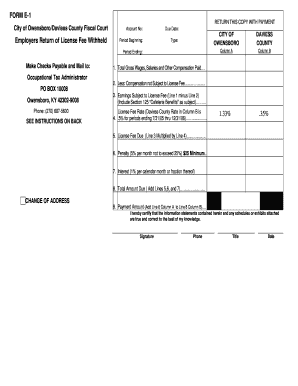

What is the Net Profit License Fee Return for Owensboro?

This is a form that must be remitted to the City annually. It reports your business’ net income. Typically, this is required to be submitted before April 15th, for the previous calendar year, just as with standard income taxes. The tax rate is 1.33% of all net profit accrued. The Net Profit License Return can be obtained at the City’s website: https://www.owensboro.org/page/doing-business-in-owensboro. Furthermore, Owensboro mandates that your Federal Tax Return be remitted with the Net Profit License Fee Return every year.

Are you considering operating a residentially-based business or a specialty business?

The application is the same for both a home-based business and a specialty business. It is found at http://www.owensboro.org/finance labeled, “Business License Application.”

What is the timeframe for the Owensboro Occupational License approval or denial?

It takes approximately two working days once the completed application and fee are received before you receive a response from the City.

Are there any additional questions or concerns?

Contact the City of Owensboro government offices at 101 East 4th Street, Owensboro, KY 42303 or call (270) 687-4444. For general information in regard to starting a business in Owensboro, Kentucky, please visit https://www.owensboro.org/page/doing-business-in-owensboro.

Click the link to your city below to apply for a business license

| Louisville | Owensboro |

There has never been a better time to get a degree. Even top Universities across the U.S. have joined the movement that’s allowing millions to get an education online. Business degrees are the perfect stepping stone for building a career, increasing earning potential, and ultimately growing your business.

Find out how to improve your knowledge and increase your earning potential by getting an online business degree. Click here to find the program that’s right for you.

Search by State

To find more information about a business license in your state choose the state below.

| Alabama | Kentucky | North Dakota |

| Alaska | Louisiana | Ohio |

| Arizona | Maine | Oklahoma |

| Arkansas | Maryland | Oregon |

| California | Massachusetts | Pennsylvania |

| Colorado | Michigan | Rhode Island |

| Connecticut | Minnesota | South Carolina |

| DC | Mississippi | South Dakota |

| Delaware | Missouri | Tennessee |

| Florida | Montana | Texas |

| Georgia | Nebraska | Utah |

| Hawaii | Nevada | Vermont |

| Idaho | New Hampshire | Virginia |

| Illinois | New Jersey | Washington |

| Indiana | New Mexico | West Virginia |

| Iowa | New York | Wisconsin |

| Kansas | North Carolina | Wyoming |

Vehicle License Fee

This site is for informational purposes only and does not constitute legal, financial or tax advise. The information on this site should not be relied upon as an official source of information and should be independently verified.